All Categories

Featured

Table of Contents

A fixed indexed universal life insurance policy (FIUL) plan is a life insurance coverage item that supplies you the chance, when effectively funded, to take part in the growth of the marketplace or an index without straight purchasing the market. At the core, an FIUL is developed to give protection for your enjoyed ones in the event that you die, however it can likewise give you a wide variety of benefits while you're still living.

The key distinctions in between an FIUL and a term life insurance coverage plan is the flexibility and the advantages outside of the survivor benefit. A term policy is life insurance that ensures payment of a specified death advantage throughout a given duration of time (or term) and a given costs. As soon as that term expires, you have the alternative to either restore it for a brand-new term, terminate or transform it to a premium protection.

Be sure to consult your economic expert to see what kind of life insurance coverage and advantages fit your requirements. An advantage that an FIUL provides is tranquility of mind.

You're not subjecting your hard-earned money to an unstable market, developing on your own a tax-deferred asset that has integrated protection. Historically, our firm was a term service provider and we're devoted to serving that company however we've adjusted and re-focused to fit the altering demands of clients and the needs of the sector.

We have actually dedicated resources to creating some of our FIULs, and we have a concentrated effort on being able to offer solid services to clients. FIULs are the fastest expanding sector of the life insurance policy market.

Insurance holders might shed cash in these items. Policy car loans and withdrawals may produce an adverse tax obligation lead to the occasion of lapse or policy abandonment, and will certainly reduce both the surrender value and survivor benefit. Withdrawals may undergo taxation within the very first fifteen years of the agreement. Clients ought to consult their tax expert when considering taking a plan car loan.

Indexed Whole Life Policy

Minnesota Life Insurance Business and Securian Life Insurance policy Business are subsidiaries of Securian Financial Group, Inc.

Iul For Retirement Income

1The policy will terminate if at any time the cash surrender cash money is insufficient to inadequate the monthly deductionsMonth-to-month 2Accessing the money value will certainly lower the available cash abandonment value and the death benefit.

In 2023, I co-wrote a short article on underperformance of indexed global life (IUL) blocks. One of the prospective motorists of that underperformance was policyholder behavior. Throughout the program of time, actuaries have actually discovered many tough lessons about misestimating insurance holder actions and the efficiency of insurance policy holders. In this write-up, I broaden on the potential locations of insurance holder behavior danger in IUL products and where actuaries must pay particular interest to the lessons of the past.

This post looks into additional behavior risks to be knowledgeable about and appeals the risks gone over in the previous article along with supplies some tips on exactly how to monitor, comprehend and potentially lower these risks. IUL is still a relatively new product, and lasting habits experience is restricted.

Those attributes, in particular if the spread goes unfavorable, can drive the item to be lapse-supported. The circumstance gets exacerbated if a business additionally has reverse pick and best expense of insurance rates or expects to eventually have unfavorable mortality margins. Insurance coverage market historic experience has shown that lapse-supported items frequently end up with best surrender prices of 1% or reduced.

Through conversations with our clients and by means of our sector studies, we understand that several firms don't model dynamic surrenders for IUL products the thought being that IUL items will not be sensitive to rate of interest activities. Companies must certainly ask themselves whether or not IUL will certainly be delicate to rates of interest motions.

This can look appealing for the insurance holder when obtaining prices are reduced and the IUL illustration is revealing 6% to 7% lasting crediting rates. What takes place when those obtaining prices increase dramatically and the utilize advantage starts to reduce or goes away? With the current rise in rates, specifically at the short end of the curve that drives loaning rates, insurance policy holders might decide to surrender their contracts.

Transamerica Index Universal Life Insurance

This presents extra behavior danger as various loan or withdrawal habits can drive different spread revenues. Contracts with reduced finance prices might also experience disintermediation if different financial investments come to be a lot more attractive loved one to their IUL policy, specifically if caps have been reduced and efficiency is lagging expectations. Poor efficiency and the inability to car loan or withdraw quantities that were formerly highlighted might likewise lead to a rise in abandonment task.

Comparable to exactly how business research mortality and lapse/surrender, companies should on a regular basis check their loan and withdrawal behavior loved one to presumptions and update those presumptions as needed. Poor performance and the inability to funding or withdraw quantities that were previously shown might likewise lead to a boost in surrender task. Many IUL firms presume some degree of decrements in establishing their bush targets, as most IUL contracts only pay the ensured crediting price up till completion of the index year.

Fidelity Iul

If you're using a simplified complete decrement price in hedge targets, you could absolutely introduce hedge inefficacy, specifically if the assumed overall decrement price comes to be stale due to absence of normal upgrading. Using a single decrement rate can also bring about hedge ineffectiveness throughout problem year friends, as more current IUL sales would commonly have a greater real decrement price than formerly issued vintages.

The influence of a gap (termination without worth) versus a surrender (termination with worth) can create a purposeful difference in incomes. Historically many companies priced and designed their UL products with a consolidated non-death discontinuation rate and an overall premium persistence presumption - iul life insurance canada. Where there declares money surrender worth designed, those total non-death terminations will certainly bring about an anticipated revenue source from collected surrender fees

Those distinctions will drive variations in actions family member to UL. As actuaries, we must gain from the past and attempt to avoid making the very same misestimations that were made on numerous UL items. Keeping that historical understanding, and the greatly improved computing power and modeling devices that are available today, you should be able to much better comprehend IUL habits risks.

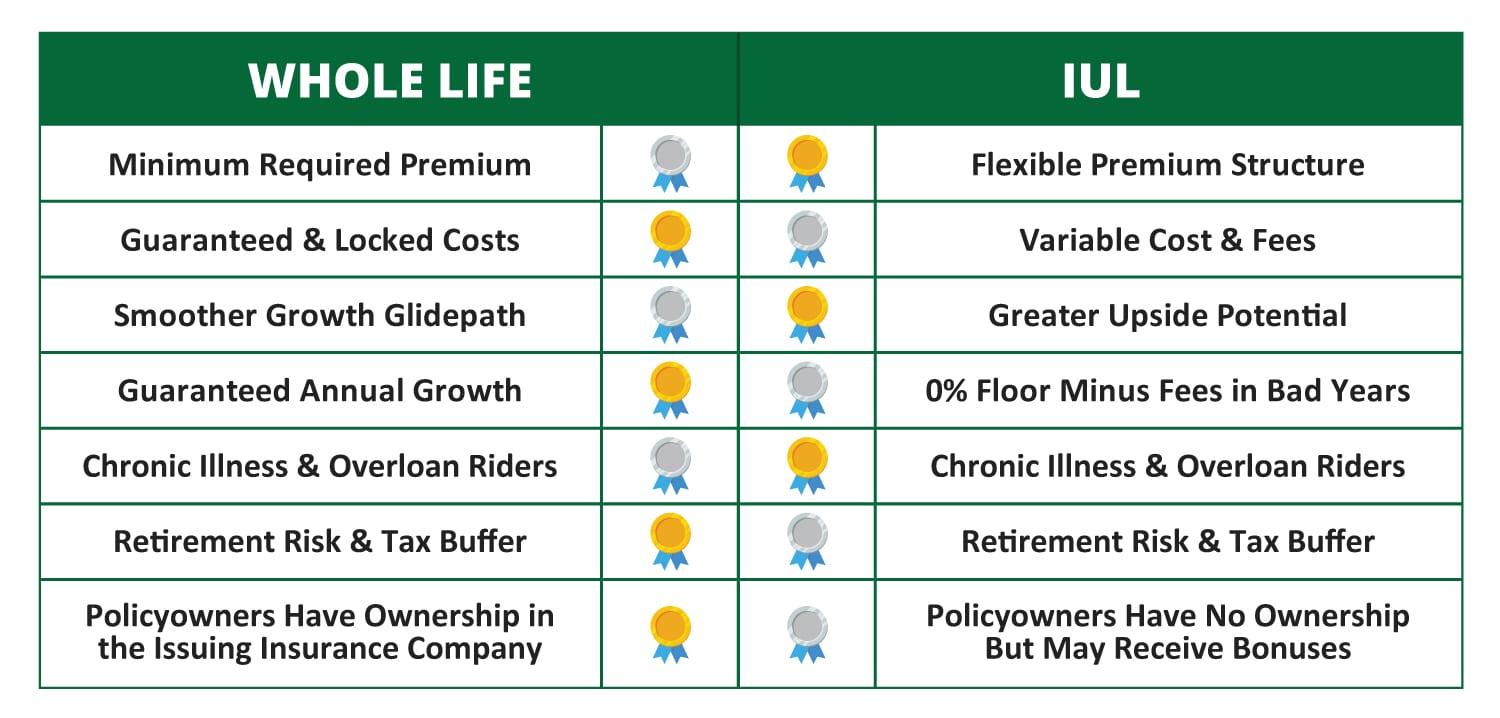

Term life and global life are significantly various items. Universal life has a variable premium and survivor benefit amount, whereas term is fixed; universal life is a long-term life insurance policy item that collects cash money worth, whereas term life only lasts for a particular period of time and just consists of a fatality advantage.

Index Universal Life Insurance Uk

You can underpay or miss premiums, plus you may be able to readjust your death advantage. What makes IUL different is the way the money value is invested. When you get an indexed universal life insurance policy policy, the insurance policy company supplies numerous choices to select at least one index to make use of for all or component of the money worth account section of your plan and your death benefit.

Versatile premiums, and a death advantage that may likewise be versatile. Cash money value, along with prospective development of that value with an equity index account. A choice to assign component of the cash money value to a fixed rate of interest choice. Minimum passion rate guarantees ("floorings"), but there may also be a cap on gains, normally around 8%-12%. Gathered money worth can be made use of to reduced or potentially cover costs without subtracting from your death benefit.

Whole Life Versus Universal Life

Policyholders can decide the percent assigned to the fixed and indexed accounts. The value of the selected index is taped at the beginning of the month and contrasted with the worth at the end of the month. If the index enhances throughout the month, interest is included in the money value.

Latest Posts

Variable Universal Life Insurance Reviews

Universal Life Safety Products

Whole Life Vs Universal Life Chart